Inflation in the US falls more than forecast

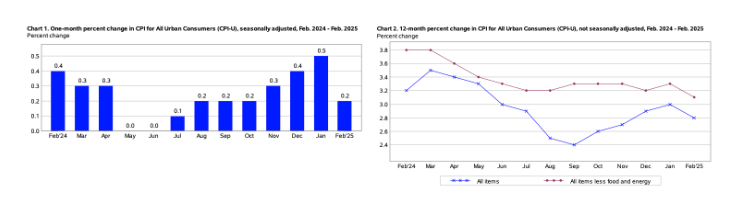

The most important event of Wednesday's session was the publication of the consumer inflation (CPI) report in the United States. It was a report from which we learned that the growth rate of consumer prices in the United States slowed down by as much as 0.3 percentage points in February 2025. from 0.5% to 0.2% on a monthly basis and by 0.2 p.p. to 2.8 per cent from 3.0 per cent year-on-year.

Both readings turned out to be lower than expected. After all, experts estimated that the CPI index would fall to 0.3% m/m and 2.9% y/y.

As if that were not enough, core inflation also fell more than expected, which due to high volatility omits energy and food prices. In this case, readings were recorded at the levels of 0.2% m/m (with forecasts assuming 0.3%) and 3.1% y/y (with forecasts assuming 3.2%).

Will the Fed cut interest rates as many as 3 this year?

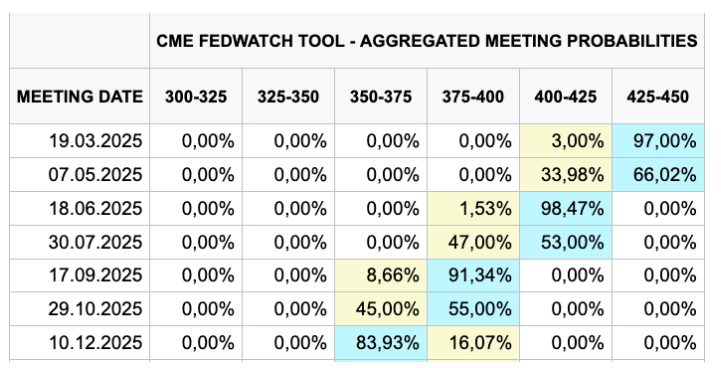

Lower-than-expected inflation readings contributed to a revision of expectations regarding future monetary actions of the US Federal Reserve (Fed). Although until recently it was assumed that the Federal Open Market Committee (FOMC) would decide on only one or a maximum of two interest rate cuts this year, it is currently estimated that the federal funds rate may be reduced up to three times this year, with the first cut having to wait until June 18 this year, and the second by September 17 this year, and for the third by 10 December this year.

Rollercoaster na USD

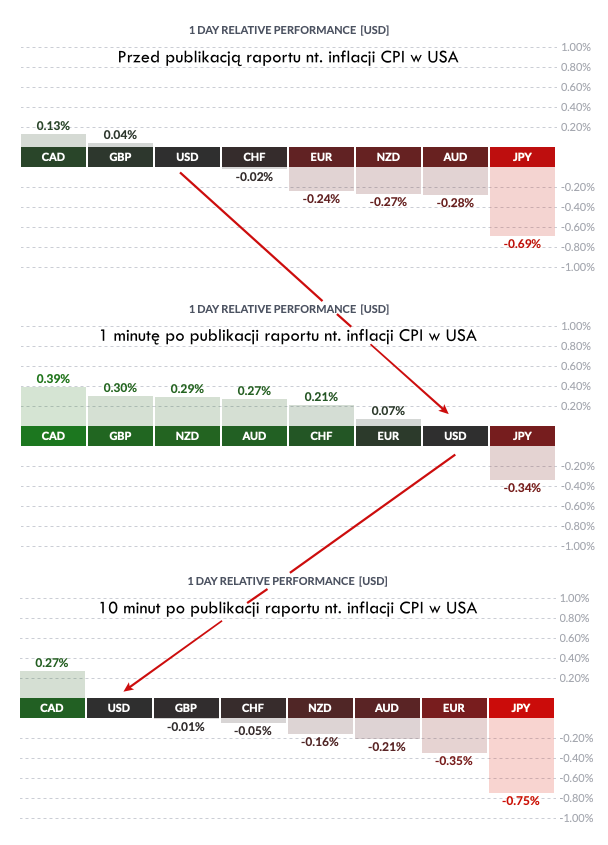

Looking at the currency market, we can see that the latest data from the American economy has led to noticeable volatility in the dollar's quotations against the other G8 currencies.

Although just before the publication of the US consumer inflation report, the dollar remained one of the strongest G8 currencies, giving way only to the pound (GBP) and the Canadian dollar (CAD), 1 minute after the publication of the aforementioned report, it was already on the opposite side of this list and gained only against the Japanese yen (JPY). In the next 9 minutes, however, he made up for all the losses and returned to the starting position.

Dollar exchange rate at its lowest level since September 2024

When it comes to the condition of the US dollar against the Polish zloty, it is worth noting that , it has been in the region of PLN 3.85 for several days, which is the lowest value since September 2024.

In order for the greenback to return to the growth path, the dollar exchange rate would first have to break above the technical resistance located in the area of 3.90 PLN.

How high will the dollar rise?

Analysts at Crédit Agricole Corporate and Investment Bank (CACIB) forecast that the dollar exchange rate will reach PLN 3.98 in the first quarter of this year, before rising to PLN 4.04 in the middle of the year.

Experts from MUFG and Barclays (LON:BARC), on the other hand, expect the US to rise towards as much as PLN 4.29 (MUFG) and PLN 4.30 (Barclays) respectively by the end of March 2025.

analysts also expect a slightly larger, although much less dynamic growth. In their opinion, the American currency will increase to the following levels:

- PLN 4.08 in the first quarter of 2025,

- PLN 4.17 in the second quarter of 2025,

- PLN 4.26 in the third quarter of 2025,

- PLN 4.35 in the fourth quarter of 2025

Even more bullish projections on the dollar's exchange rate against the Polish zloty were presented by experts from RBC Capital Markets. In their opinion, the greenback will increase in the first quarter of this year to as much as PLN 4.36.

The dollar exchange rate may increase by 70 groszy

HSBC analysts, on the other hand, estimate that the dollar exchange rate will increase in the first quarter of this year "only" to PLN 4.17, but in the second, third and fourth quarters of 2025 it will reach PLN 4.31, PLN 4.44 and PLN 4.55, respectively.

Taking into account that currently one dollar costs PLN 3.85, we are talking about its potential increase by as much as 70 groszy.

Analysts revise USD/PLN forecasts

Until recently, Goldman Sachs (NYSE:GS) experts represented the most bullish attitude towards the pair, who in their projections indicated the possibility of an increase in the dollar exchange rate towards PLN 4.30 in the next 3 months, PLN 4.54 in the next 6 months and as much as PLN 4.64 in 12 months.

Seeing how clearly the dollar is losing against the zloty, they decided to revise their forecasts. Currently, they assume that the dollar exchange rate will increase to PLN 4.12 in the next 3 months, PLN 4.21 in the next 6 months and as much as PLN 4.34 in 12 months.

FAQ

How much is $1 in an exchange office?

The exchange rate of the dollar to the Polish zloty varies depending on the exchange office. And so for one dollar you have to pay respectively:

- PLN 3.86 on the Walutomat currency exchange platform

- PLN 3.87 in the exchange office InternetowyKantor.pl

- PLN 3.88 in Santander Bank Polski exchange office

- PLN 3.88 in the PKO BP (WA:PKO) exchange office

- PLN 3.87 in Alior Bank (WA:ALRR)'s exchange office

How much is $100 in a currency exchange?

Taking into account the different prices for one dollar in individual currency exchange offices, for 100 dollars you should pay respectively:

- PLN 386.37 on the Walutomat currency exchange platform

- PLN 387.06 in the exchange office InternetowyKantor.pl

- PLN 387.63 in Santander Bank Polski exchange office

- PLN 387.94 in the PKO BP exchange office

- PLN 386.92 in Alior Bank's exchange office

What is the current dollar exchange rate?

The National Bank of Poland (NBP) set the exchange rate of the dollar (USD) against the Polish zloty (PLN) on Wednesday, March 12, 2025 at PLN 3.8496, increasing it symbolically from PLN 3.8481 on Tuesday.

The exchange rate of the dollar to the Polish zloty on the currency market is currently 3.8537 PLN.