Oto dlaczego według Citi ceny kryptowalut ostatnio słabną

- All eyes are on US inflation data, which will be released today.

- A slight decline in the core CPI and a marginal increase in the overall CPI are expected.

- Given the uncertainty regarding interest rate cuts, defensive portfolios and rotation strategies seem to be the most reasonable solution.

- Invest big for less than PLN 38 per month with our artificial intelligence-based ProPicks stock selection tool. Find out more here>>

Today, inflation data in the US will be published, which is definitely the most important event of the week.

Estimates suggest we will see both monthly and annual declines in the core CPI component, while the overall CPI component is expected to decline on a scale of {{ecl-733| |monthly}} and show a slight increase over the year scale.

Here are the specific expectations:

- Annual core CPI: expected to decline slightly from 3.8% to 3.7%.

- Annual CPI: projected to increase from 3.2% to 3.4%.

- Monthly Core CPI: Projected to decline slightly from 0.4% to 0.3%

- Monthly CPI: projected to decline slightly from 0.4% to 0.3%

In terms of asset classes, if data performs as expected, some sectors may see revaluations. Belong to them:

It is common for Treasury yields to decline as an initial reaction to lower-than-expected CPI data (and vice versa).

However, in Italy there is a saying: "Canta e suona" (this guy sings and plays to himself), which means someone who tells stories that only he believes. Well, I think the market is singing its own song about interest rate cuts.

So we have to think: what if things don't go according to plan? What if, for example, there is no rate cut in 2024 because inflation has not yet been tamed?

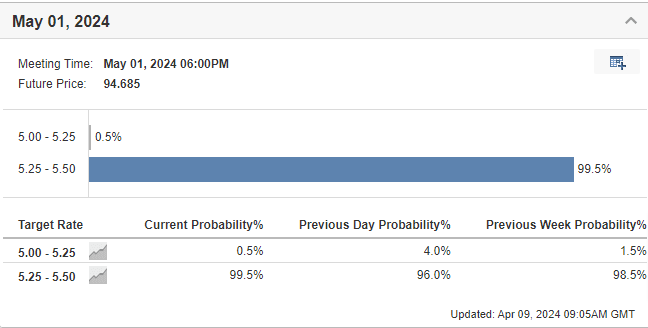

It is worth noting that since the end of last year, markets were initially convinced about a rate cut in March (which did not happen). Now, even in May, confidence is decreasing and the chances of keeping rates unchanged are 98.5%.

We do not automatically assume that a rate cut will occur. Instead, we focus on planning different solutions. Currently, I believe that the best options are defensive portfolios that work no matter what happens and rotational strategies.

***

Be sure to take advantage of the InvestingPro+ discount on the annual plan (click HERE), where you can discover undervalued and overvalued stocks using exclusive tools: ProPicks, AI-managed stock portfolios and expert analysis.

Use ProTips for simplified information and data, fair value and financial health indicators for quick insight into stock potential and risk, stock selectors, historical financial data on thousands of stocks, and more!

Disclaimer: The author is long in Paypal, S&P 500 and Nasdaq . This article has been written for informational purposes only; it does not constitute a solicitation, offer, advice, advice or recommendation to invest, and as such is not intended to encourage the purchase of assets in any way. "I would like to remind you that each type of asset is assessed from many points of view and is highly risky, and therefore each investment decision and the risks associated with it remain at the discretion of the investor."

Które akcje warto wziąć pod uwagę podczas następnej transakcji?

Inwestorzy odnoszący sukcesy wiedzą, że przed podjęciem decyzji należy sprawdzić wiele aspektów. Trzy potężne funkcje InvestingPro współpracują ze sobą, aby zapewnić Ci przewagę:

ProPicks AI stosuje ponad 80 strategii typowania akcji, w tym Tytani technologiczni. Funkcja ta wskazała akcje, których cena podwoiła się w stosunku do indeksu S&P 500 w ciągu zaledwie 18 miesięcy!

Wartość godziwa łączy 17 sprawdzonych modeli wyceny, aby pomóc w znalezieniu przecenionych akcji i niedocenianych perełek.

WarrenAI dostarcza natychmiastowych informacji na temat każdej akcji. Zadawaj pytania i otrzymuj sprawdzone odpowiedzi oparte na danych w czasie rzeczywistym (w przeciwieństwie do ChatGPT).

Nasi subskrybenci korzystają z wszystkich trzech narzędzi do typowania akcji zanim osiągną dwucyfrowy wzrost, aby uniknąć kosztownych błędów.

Jednak nawet jeśli korzystasz tylko z jednej z tych funkcji, jego wartość zwraca się podczas naszej wcześniejszej promocji z okazji Black Friday z 55% zniżką.