The material was commissioned by Dom Maklerski Banku BPS SA

WIG-20 lost a lot in the first part of the Wednesday session, but later made up for these losses by closing only 0.02 percent. below the end level of the previous session. This enabled another increase in MACD, which generated a buy signal on Tuesday. Short-term resistance seems to be well defined: it is a falling 200-session average (2230 points), a falling upper limit of the Bollinger band (2221 points), the growing support line of the previous upward trend broken at the beginning of December (about 2190 points) and also horizontal support broken at the beginning of December (around 2175 points). The WIG-20 should not break this resistance zone on foot, but it is not known whether it will reach it immediately (as was the case with the corresponding October-November 2018 movement),

Adverse local factors have caused our stock market to lag far behind other emerging markets. If WIG - as almost always in the past adhered to the global pattern or MSCI Emerging Markets Index (in the income version like WIG and in local currencies) it would now have a value such as February 2, 2018 or about 65,000 points. Meanwhile, on Wednesday it closed at 57170 points. One can only hope that foreign investors are not memorable and at some point the money earned on other EMs will be transferred to the WSE closing the gap.

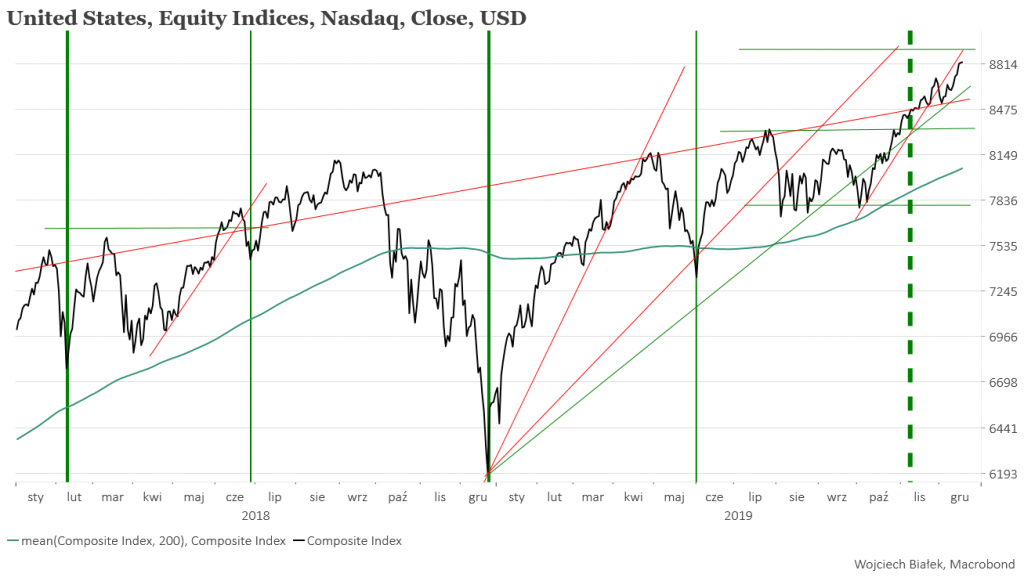

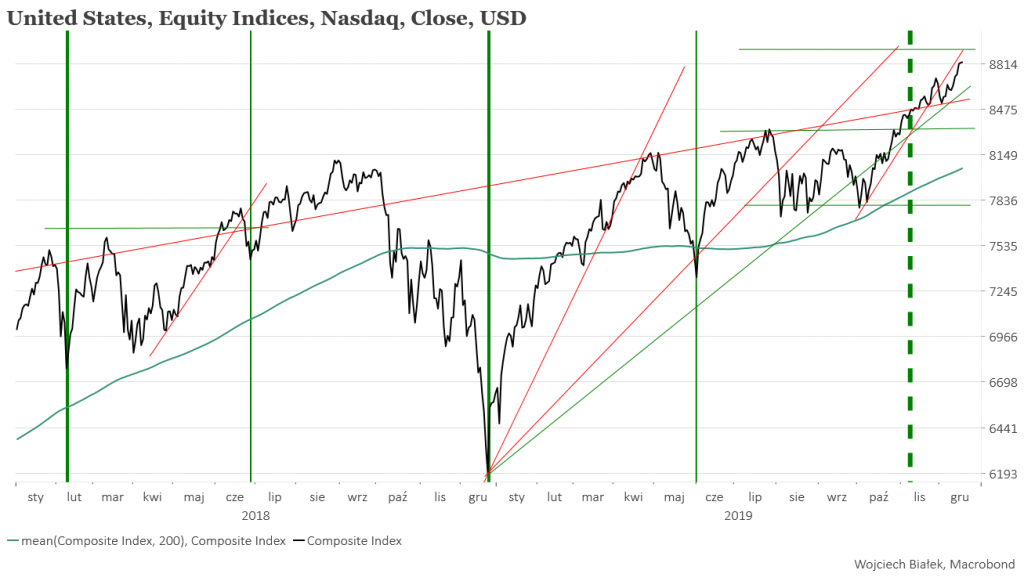

It is usually the case that when the course of a financial instrument reaches the key resistance, creating a perfect situation for speculators to open short positions, and then breaks through this resistance, the amount of punishment unlucky holders of short positions have to pay is equal to the amount of consolidation preceding this break in resistance. It seems that in the case of Nasdaq Composite, this dimension of the penalty is an increase to around 8913. Later, a correction should come, which, however, seems to reach a maximum of 8520 points.

The share price of SECO / WARWICK (WA: SWG) (C / Z 9.4, C / WK 0.88, dividend rate 2.4%), a producer of furnaces for metal heat treatment, reached in this around historical minima levels and for now defended this support. He is currently struggling with a falling resistance line passing through local summits from the last 3 years. Its possible break would probably open the way to growth.

The share price of Herkules (WA:HRSP) (formerly Gastel Żurawie, even earlier EFH Żurawie Wieżowe; C / WK 0.19) is in a very strong bear market, which usually means that dealing with these assets is associated with a very high risk. It is often the case that speculators take this risk when the rate drops by more than 50 percent. below traditional resistance, i.e. the 200-session average. This condition was met for the Hercules course in December. Three previous similar episodes ended sooner or later with a temporary exit of the course above the falling 200 session average.

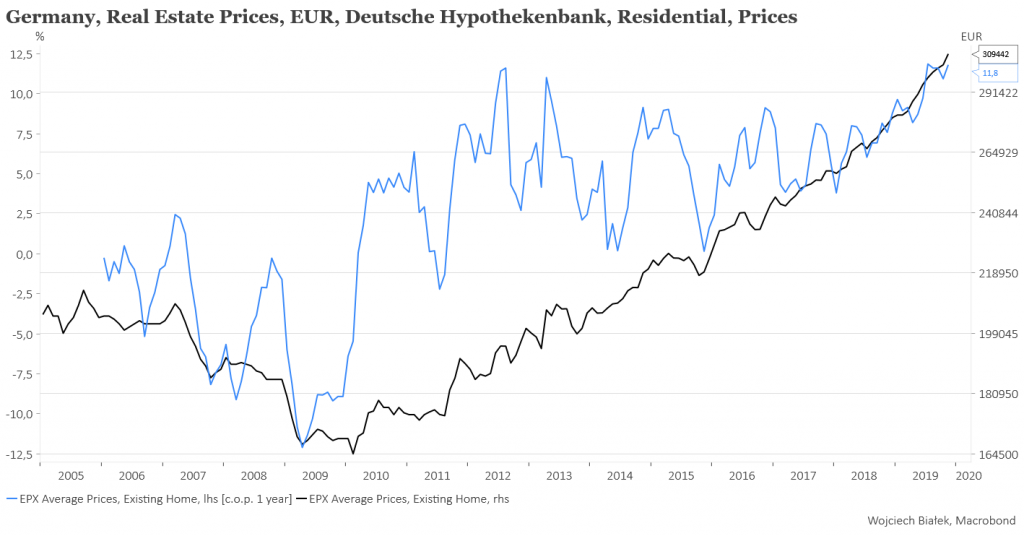

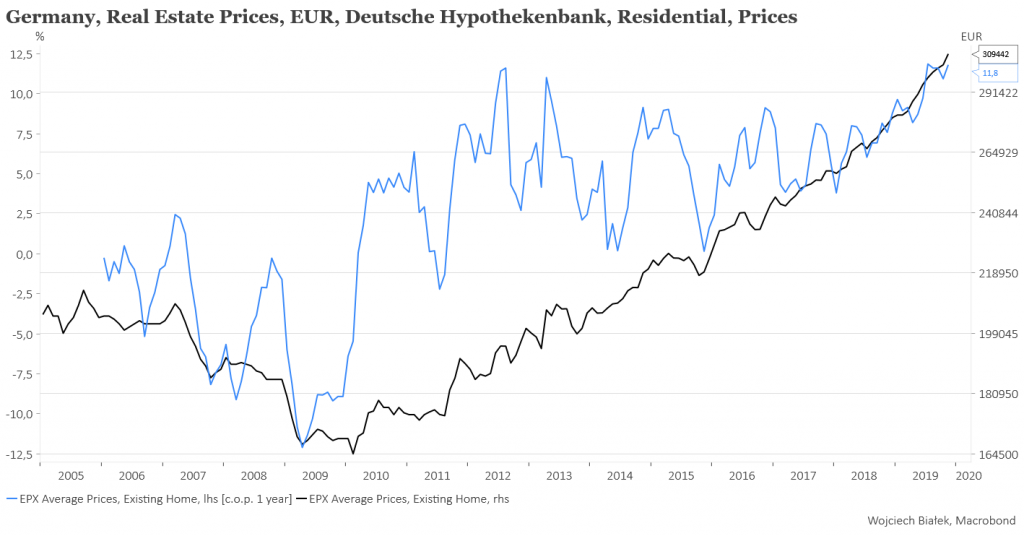

The more interesting macroeconomic data published in the country and in the world over the past 24 hours include the persistently high dynamics of residential property prices in Germany (+11,8% in November):

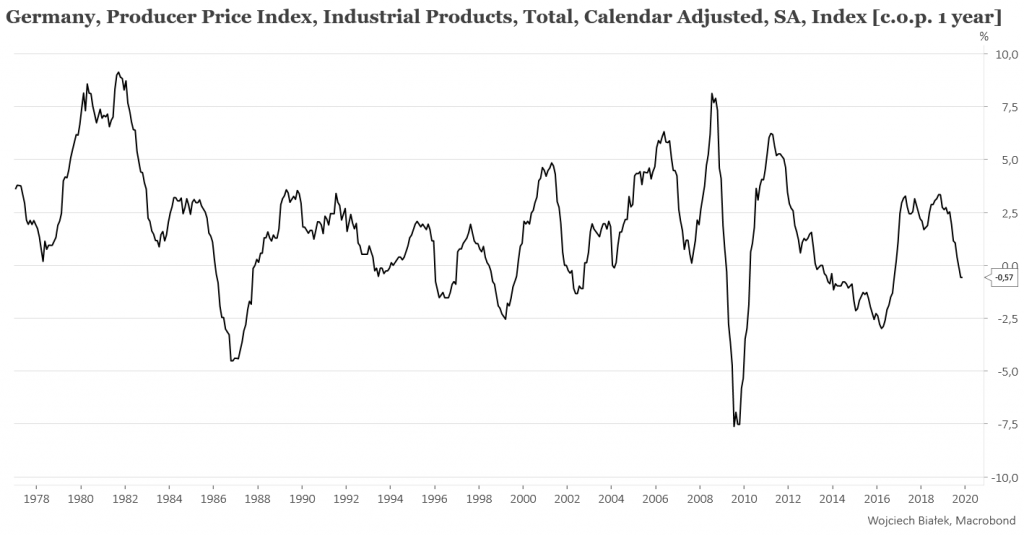

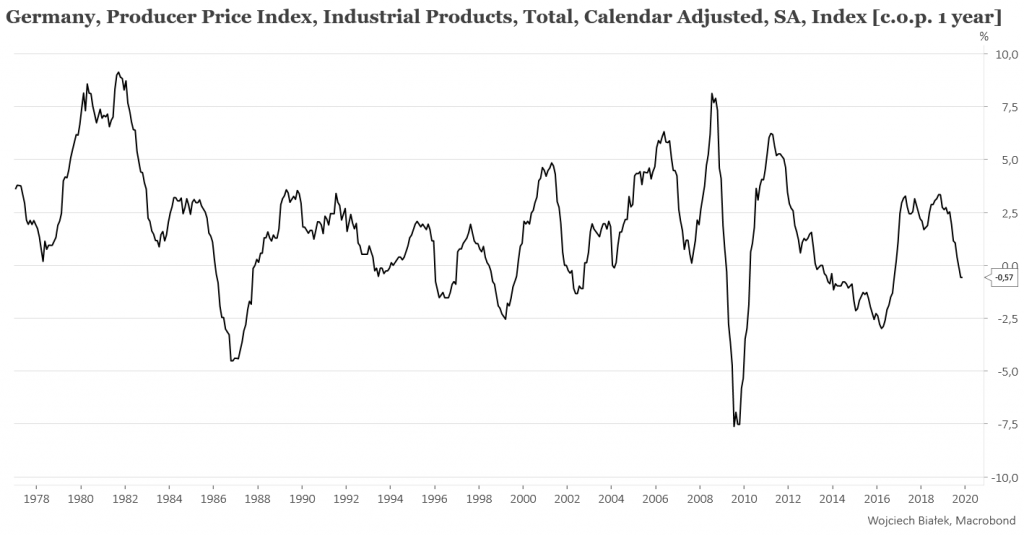

... still negative dynamics PPI in Germany in November:

... a drop in economic and business indicators published by Konjunkturinstituted in Sweden in December to the lowest levels for several years (with a slight increase in the consumer confidence index):

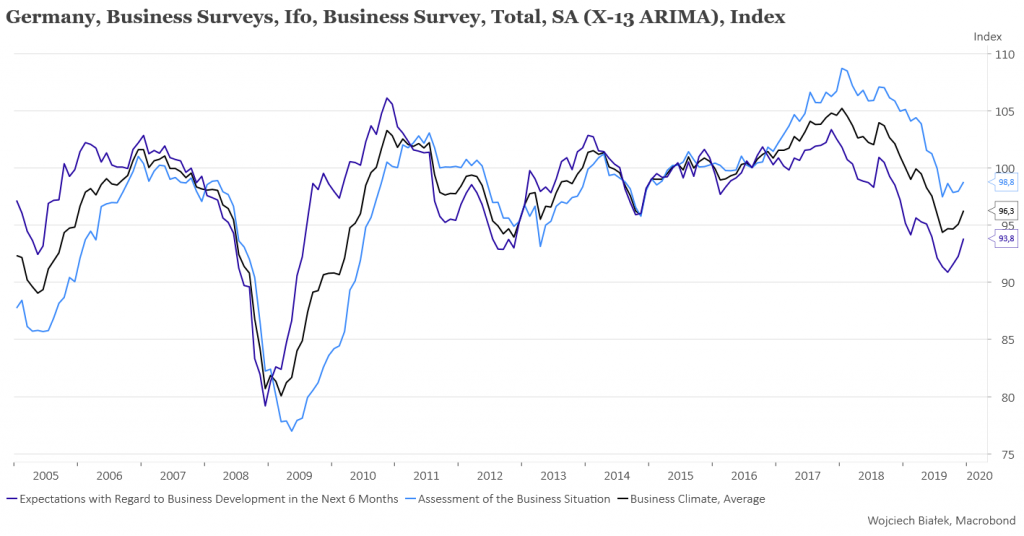

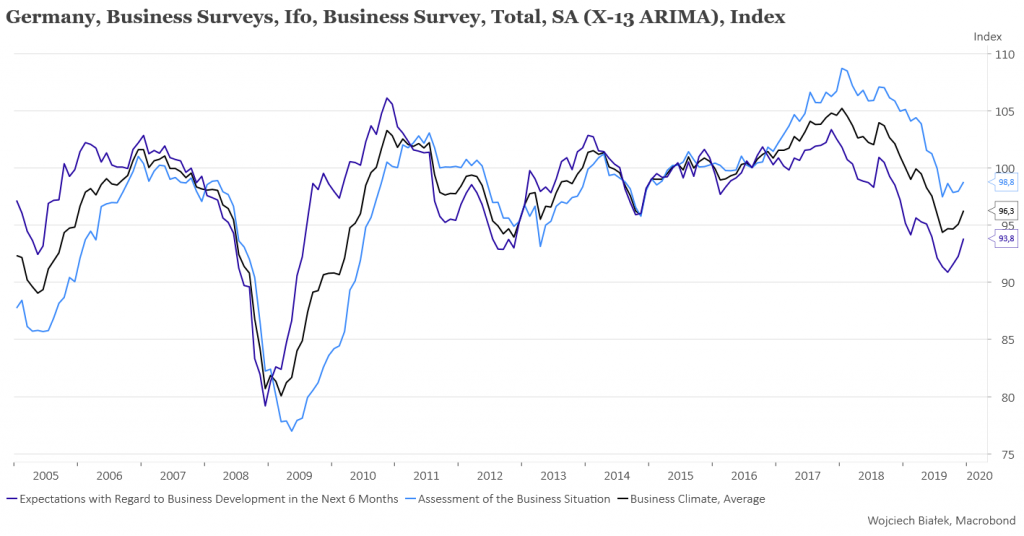

... another increase from the lowest IFO levels in a decade in Germany in December:

... a decrease in the CSO consumer confidence index in Poland to the lowest level this year:

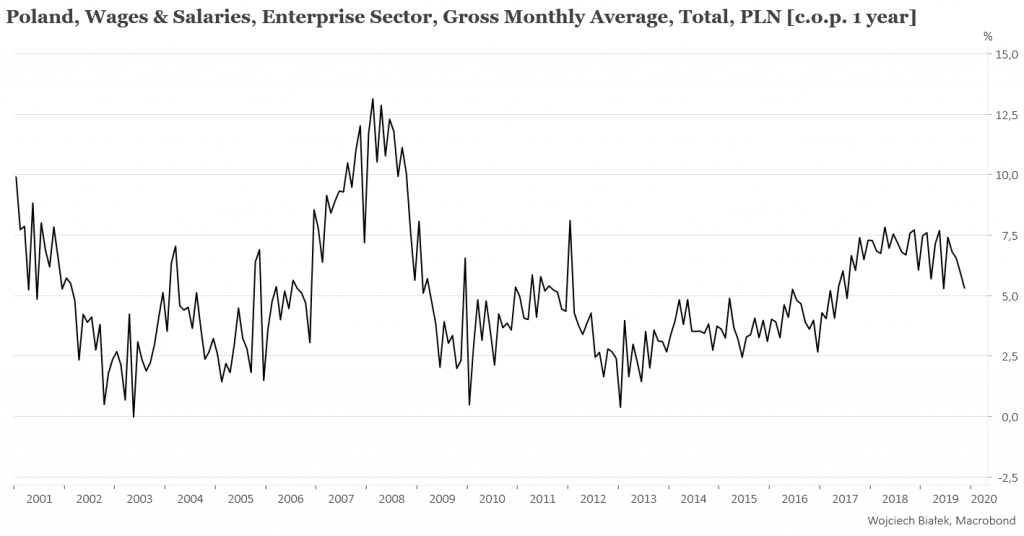

... a decrease in the annual wage dynamics in the enterprise sector in Poland:

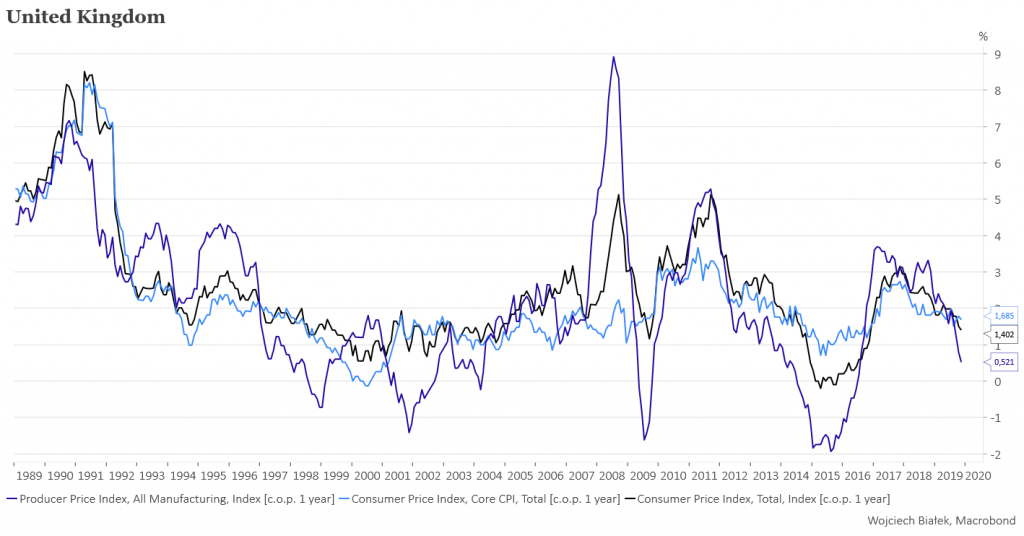

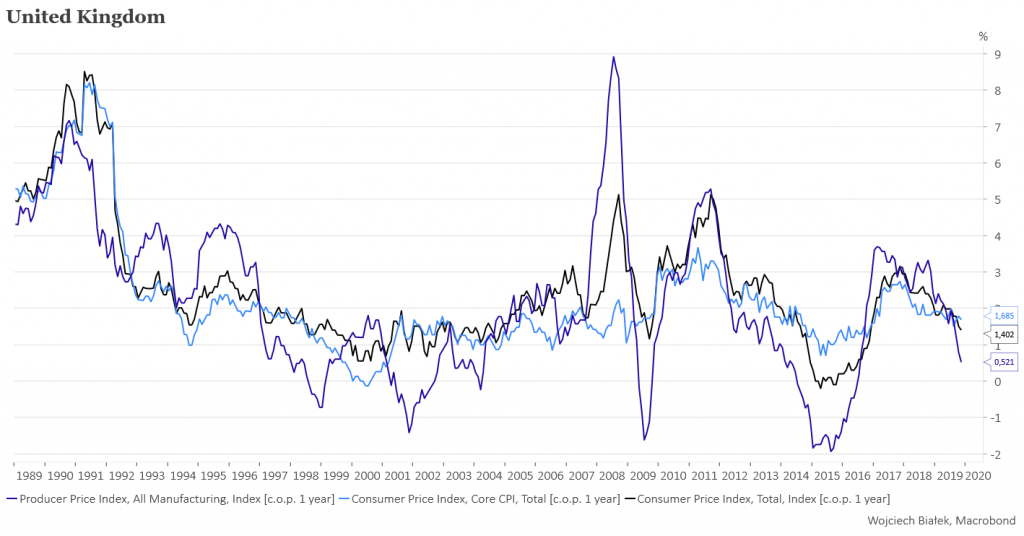

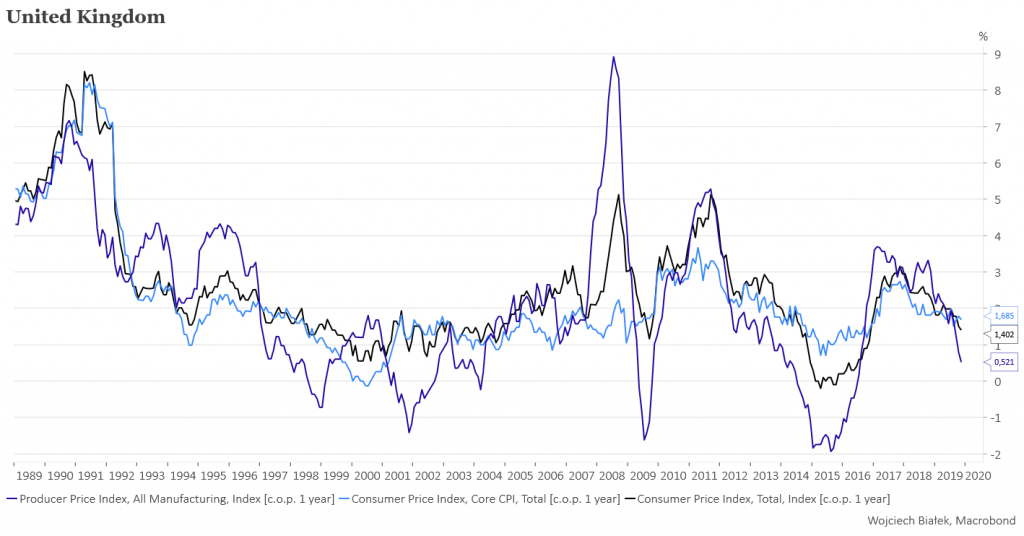

... data on the dynamics of the main indicators inflation in the United Kingdom in November:

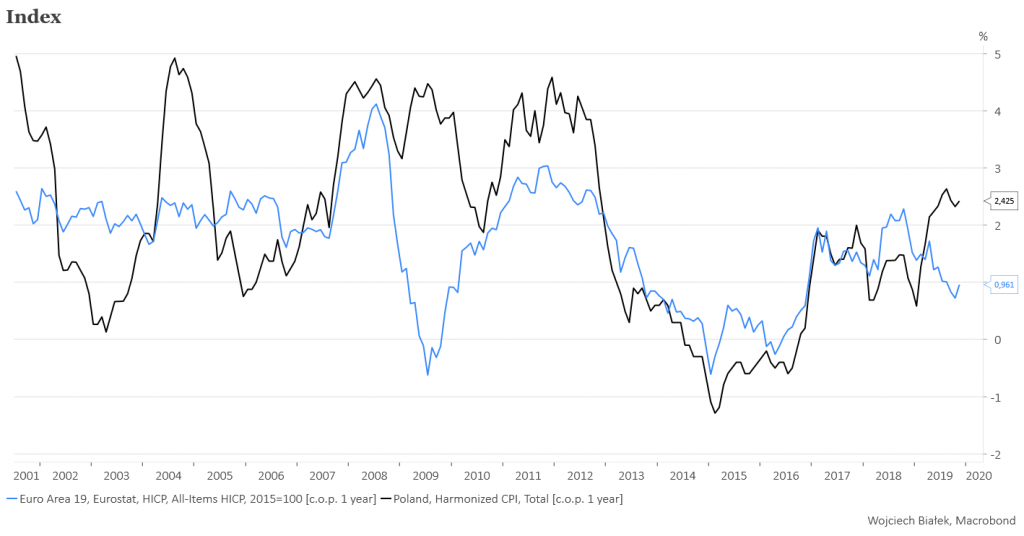

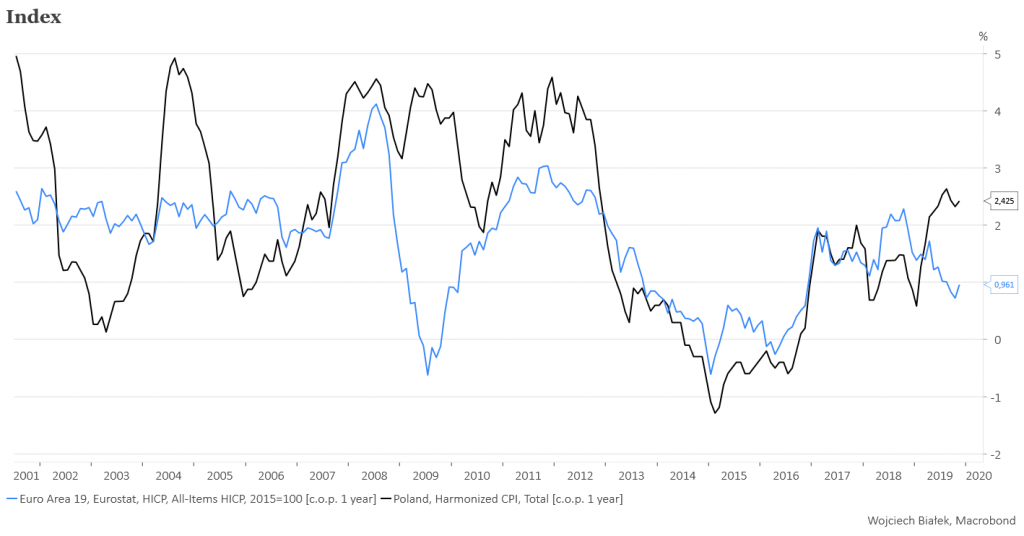

... and information on the increase in the annual dynamics of harmonized inflation indicators in the euro area and Poland:inflacji

WIG-20 lost a lot in the first part of the Wednesday session, but later made up for these losses by closing only 0.02 percent. below the end level of the previous session. This enabled another increase in MACD, which generated a buy signal on Tuesday. Short-term resistance seems to be well defined: it is a falling 200-session average (2230 points), a falling upper limit of the Bollinger band (2221 points), the growing support line of the previous upward trend broken at the beginning of December (about 2190 points) and also horizontal support broken at the beginning of December (around 2175 points). The WIG-20 should not break this resistance zone on foot, but it is not known whether it will reach it immediately (as was the case with the corresponding October-November 2018 movement),

Adverse local factors have caused our stock market to lag far behind other emerging markets. If WIG - as almost always in the past adhered to the global pattern or MSCI Emerging Markets Index (in the income version like WIG and in local currencies) it would now have a value such as February 2, 2018 or about 65,000 points. Meanwhile, on Wednesday it closed at 57170 points. One can only hope that foreign investors are not memorable and at some point the money earned on other EMs will be transferred to the WSE closing the gap.

It is usually the case that when the course of a financial instrument reaches the key resistance, creating a perfect situation for speculators to open short positions, and then breaks through this resistance, the amount of punishment unlucky holders of short positions have to pay is equal to the amount of consolidation preceding this break in resistance. It seems that in the case of Nasdaq Composite, this dimension of the penalty is an increase to around 8913. Later, a correction should come, which, however, seems to reach a maximum of 8520 points.

The share price of SECO / WARWICK (WA: SWG) (C / Z 9.4, C / WK 0.88, dividend rate 2.4%), a producer of furnaces for metal heat treatment, reached in this around historical minima levels and for now defended this support. He is currently struggling with a falling resistance line passing through local summits from the last 3 years. Its possible break would probably open the way to growth.

The share price of Herkules (WA:HRSP) (formerly Gastel Żurawie, even earlier EFH Żurawie Wieżowe; C / WK 0.19) is in a very strong bear market, which usually means that dealing with these assets is associated with a very high risk. It is often the case that speculators take this risk when the rate drops by more than 50 percent. below traditional resistance, i.e. the 200-session average. This condition was met for the Hercules course in December. Three previous similar episodes ended sooner or later with a temporary exit of the course above the falling 200 session average.

The more interesting macroeconomic data published in the country and in the world over the past 24 hours include the persistently high dynamics of residential property prices in Germany (+11,8% in November):

... still negative dynamics PPI in Germany in November:

... a drop in economic and business indicators published by Konjunkturinstituted in Sweden in December to the lowest levels for several years (with a slight increase in the consumer confidence index):

... another increase from the lowest IFO levels in a decade in Germany in December:

... a decrease in the CSO consumer confidence index in Poland to the lowest level this year:

... a decrease in the annual wage dynamics in the enterprise sector in Poland:

... data on the dynamics of the main indicators inflation in the United Kingdom in November:

... and information on the increase in the annual dynamics of harmonized inflation indicators in the euro area and Poland:inflacji